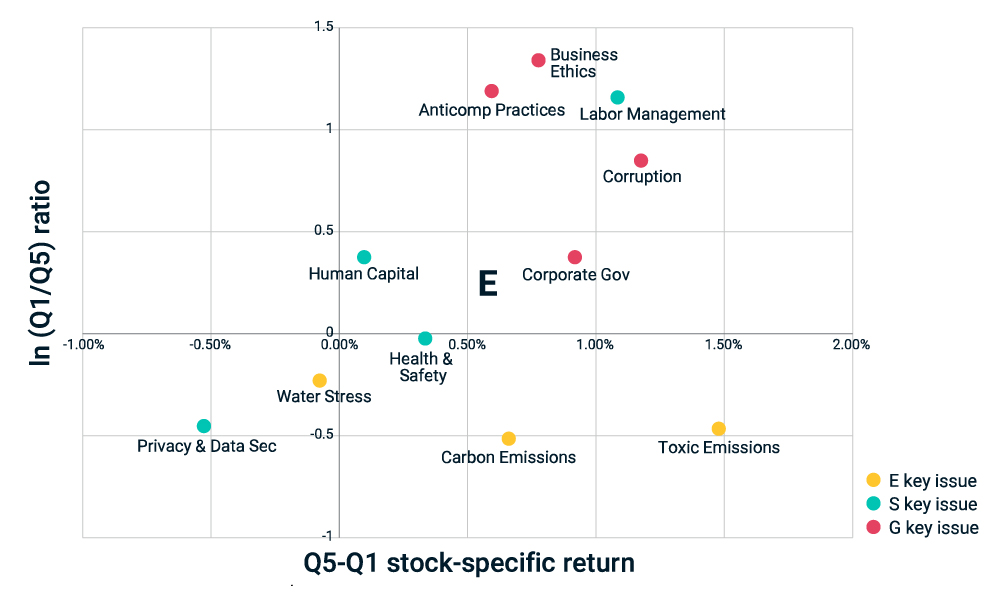

Time horizons are key to understanding the impact of environmental, social and governance (ESG) on stock returns. This paper, which was published in Investments & Wealth Monitor, illustrates the relative importance of short-term event-related risks (such as fraud, corruption or accidents) versus longer-term erosion risks (such as carbon emissions) over time. It also examines the relationship between ESG risks and specific issues that are used in calculating a company’s ESG rating.

For example, short-term event-driven risks, such as fraud or corruption, are frequently tied to the G pillar. Others, such as accidents, strikes or oil spills, may be tied to E and S scores. In contrast, erosion risk represents long-term risk, often reflecting environmental and social issues’ contributions to stock-price performance.

Event risk vs. erosion risk of 11 MSCI ESG Key Issues